Introduction

Company name reservation in Pakistan is the cornerstone of a successful and legally compliant business registration journey. It not only marks the first formal step toward launching a company, but also provides essential legal recognition, exclusive brand identity, and a solid foundation for all subsequent legal and financial operations. Whether you’re registering a startup, small enterprise, or a full-fledged private limited company, your business name is the first impression you make in the market—and reserving it early ensures it’s protected and unique.

In Pakistan, name reservation is a mandatory process governed by the Securities and Exchange Commission of Pakistan (SECP) under the Companies Act, 2017. The chosen name must be distinct, non-offensive, legally acceptable, and reflective of your business’s intended operations. This simple but critical step ensures your company avoids future conflicts, legal disputes, or regulatory rejections.

Navigating the SECP’s eServices portal, understanding name availability rules, and complying with naming restrictions can feel overwhelming—especially for first-time business owners. That’s why it’s essential to approach this process with a strategic mindset, backed by expert guidance.

This guide will walk you through every step of the company name reservation process in Pakistan—from selecting the right business name to integrating that reservation with tax registration, payroll setup, and bookkeeping systems. You’ll also gain insights into common mistakes to avoid, frequently asked questions, and post-reservation compliance steps, including how to register with the Federal Board of Revenue (FBR), manage income tax filing, and streamline operations with tools like QuickBooks, Xero, and ZohoBooks.

At Arshad & Associates, we’ve successfully helped hundreds of entrepreneurs and businesses reserve company names, complete SECP registrations, navigate taxation, and implement robust accounting systems tailored to their industries. This comprehensive resource reflects our years of practical expertise in business compliance, finance, and digital bookkeeping.

Whether you’re starting from scratch or expanding an existing venture, this guide is your go-to reference for launching your business the right way—compliant, efficient, and future-ready.

Historical Background of Company Registration in Pakistan

The regulatory journey of company registration in Pakistan has evolved significantly over the last century, reflecting both historical context and the growing complexity of modern business operations. It began with the Companies Act of 1913, enacted during the British colonial era, which laid the foundational legal framework for corporate governance across the Indian subcontinent. This legislation remained in force even after Pakistan gained independence in 1947 and continued to serve as the governing law for company formation and administration for several decades.

However, as Pakistan’s economy began to grow and diversify, there emerged a need for more robust, localized, and business-friendly regulations. This led to the introduction of the Companies Ordinance, 1984, which replaced the colonial-era act and introduced more comprehensive legal provisions to regulate company affairs. The 1984 ordinance was a substantial step forward, as it incorporated better mechanisms for corporate compliance, shareholder protection, and company disclosures. It governed Pakistani corporate law for over 30 years and laid the groundwork for a formalized process of company registration, name reservation, and ongoing regulatory compliance.

Recognizing the rapid changes in global business practices and the need to streamline corporate procedures in a digital economy, the Companies Act, 2017 was introduced to replace the 1984 ordinance. The new law modernized the company incorporation process in Pakistan, reduced bureaucratic hurdles, and promoted ease of doing business by simplifying paperwork, introducing online filings, and making compliance more transparent. Key improvements included digitization of company data, simplified filing requirements for small businesses, and increased oversight on beneficial ownership and anti-money laundering compliance.

Alongside these regulatory reforms, the Securities and Exchange Commission of Pakistan (SECP) was established in 1999 under the SECP Act. As the apex regulatory authority for corporate entities in the country, SECP is responsible for overseeing the incorporation of companies, regulating the capital market, and managing the insurance and non-banking financial sectors. It administers the entire process of company name reservation, company incorporation, and post-registration compliance via its user-friendly online platform—the SECP eServices portal.

Today, the SECP is not only a gatekeeper of corporate legality but also a key facilitator of entrepreneurship in Pakistan. Through its initiatives, it encourages transparency, ensures investor protection, and provides a framework for sustainable corporate growth. Understanding this legal and regulatory history is crucial for anyone intending to register a company in Pakistan, as it highlights the structured evolution toward more business-friendly and digitalized incorporation processes.

What Is SECP and Why Is It Important?

The Securities and Exchange Commission of Pakistan (SECP) serves as the apex regulatory authority overseeing the corporate sector, capital markets, and a wide range of financial services within Pakistan. Established in 1999 under the SECP Act, it plays a central role in maintaining transparency, accountability, and regulatory compliance across all incorporated entities. Its jurisdiction extends not only to company incorporations but also to the regulation and supervision of non-banking financial institutions (NBFIs), insurance companies, mutual funds, modarabas, leasing companies, and stock exchanges.

For entrepreneurs looking to start a business in Pakistan, the SECP is the first and most critical institution they must interact with. It acts as the official gateway to legally formalize a business structure—whether it’s a private limited company, single-member company, public limited company, or a limited liability partnership (LLP). Among its many roles, one of the most essential functions is overseeing the company name reservation process, which must be completed before any business can be formally incorporated under Pakistani law.

To facilitate ease of doing business, the SECP has developed a digital platform known as the SECP eServices Portal. This online portal provides a user-friendly, step-by-step system that allows entrepreneurs, accountants, and legal consultants to carry out core functions including:

- Submitting company name reservation requests

- Checking the availability of business names in real time

- Uploading required incorporation documents

- Generating and paying government fees online

- Tracking the status of applications and approvals

The portal is designed to reduce manual paperwork, cut down on approval times, and improve the overall efficiency of corporate registration. Through this platform, users can also apply for digital signatures, manage company updates, and access a wide range of legal templates and circulars issued by the SECP.

Every aspiring business owner in Pakistan—whether a tech startup founder, real estate investor, or eCommerce merchant—must interact with the SECP from the outset of their business journey. Engaging with the SECP not only ensures that your company is legally incorporated but also opens the door to formal business activities, including income tax registration, bank account opening, and government tenders. By securing your name through SECP and moving through its streamlined processes, you establish your business on a firm legal and professional footing.

How to Use SECP eServices Portal for Name Reservation

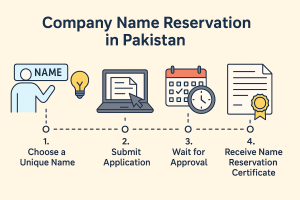

Reserving a company name through the SECP eServices portal is a critical and mandatory step in the company incorporation process in Pakistan. The system is designed to make the process smooth, accessible, and digital—eliminating the need for in-person visits or excessive paperwork. Below is a comprehensive breakdown of how you can reserve a business name through the SECP’s official platform:

🔹 Step 1: Visit the SECP eServices Portal

To begin, navigate to the official SECP eServices website at https://eservices.secp.gov.pk. This portal is the one-stop digital solution for all company incorporation services, including company name reservation, incorporation, document submission, and fee payment.

🔹 Step 2: Create a User Account

If you’re a first-time user, you must register for an account. Select the option for individual or consultant registration depending on your role. Enter your CNIC (for Pakistani nationals) or passport number (for foreign nationals), along with your personal and contact details. A verification email will be sent to activate your account.

🔹 Step 3: Select the ‘Name Reservation’ Service

Once logged in, select “Name Reservation” under the Company Incorporation tab. This will take you to the online Form A, which is specifically designed for requesting a new company name.

🔹 Step 4: Fill Out Form A

In this form, you will be required to:

- Enter up to three preferred company names in order of priority (first preference is most likely to be approved)

- Choose the type of company you intend to register (e.g., Private Limited, Single Member Company)

- Provide a concise description of the business activity

- Add basic contact information such as phone number and email address

Make sure the name you choose accurately reflects your business nature and is not misleading. For instance, avoid using “Bank” if you are not in the financial sector, as this would likely lead to a rejection.

🔹 Step 5: Review and Pay the Government Fee

Once Form A is completed, the system will generate a Challan Form for the government fee. The current fee is Rs. 200 and can be paid via online banking, mobile wallet, or at designated bank branches. After payment, upload the paid challan receipt back into the portal to proceed.

🔹 Step 6: Submit the Application

After fee submission and document upload, confirm the details and submit your name reservation request. You will receive an email confirmation acknowledging receipt of your application.

🔹 Step 7: Wait for Approval or Rejection

SECP typically processes name reservation requests within 1–2 business days. You will receive an official response via email. If your first preference is approved, the other two names are automatically disregarded. If none of your names are approved, you will be asked to reapply with new options.

✅ Pro Tips for Approval:

- Use descriptive and unique names that relate to your business activity.

- Avoid restricted or sensitive terms like “Foundation,” “Authority,” “Trust,” “Pakistan,” “Islamic,” or “Government,” unless you have legal permission.

- Avoid names identical or confusingly similar to existing registered companies by using the SECP’s name availability search tool beforehand.

- Always spell-check your entries and use correct legal formats such as “(Pvt.) Ltd.” for private limited companies.

Once approved, the reserved name will be valid for 60 days, during which you must complete the incorporation process. Failing to do so will result in expiration, and the name will be released back into the availability pool.

Tips for Choosing a Scalable Business Name

Choosing a company name is not just about availability—it’s about vision. Your company name is the foundation of your brand identity, your first impression to clients, and a key element of your long-term business strategy. One of the most common mistakes entrepreneurs make during the company name reservation in Pakistan is selecting a name that is too narrow, restrictive, or short-sighted in terms of growth potential.

🔹 Avoid Overly Specific Names That Limit Expansion

For example, a name like “Karachi Tech Repairs Pvt Ltd” may seem logical at the beginning if you’re only offering repair services in Karachi. However, this kind of geographic and service-specific naming may limit your ability to expand into other cities, diversify your offerings, or reposition your brand later on.

Let’s say in a few years you want to:

- Launch operations in Lahore, Islamabad, or internationally

- Expand from tech repair to selling hardware, offering IT consulting, or developing software

- Collaborate with a foreign partner or bring in investors who prefer a broader brand identity

A hyper-specific name could become a barrier instead of a brand asset. It may confuse potential customers and dilute your perceived capability. Moreover, a name too closely tied to one region may not rank well in search engine optimization (SEO) when you try to target new markets online.

🔹 Use Flexible and Broad Business Terminology

Instead of locking your identity into a tight niche, consider more scalable alternatives. Using general, but professional, business terms allows you to grow vertically (adding services) or horizontally (adding locations or markets) without needing a complete rebranding.

Here are some words you can use to build scalable names:

- Solutions (e.g., “Nexa Solutions Pvt Ltd”)

- Systems (e.g., “SmartLink Systems SMC Pvt Ltd”)

- Technologies (e.g., “Zion Technologies Ltd”)

- Enterprises (e.g., “Vertex Enterprises Pvt Ltd”)

- Holdings (e.g., “Orbit Holdings Ltd”)

- Group (e.g., “Altair Group”)

Such words give your business room to grow while sounding professional and trustworthy. They also allow you to pivot into new areas of opportunity without legal or branding hurdles.

🔹 Align With Your Business Activity and SEO Goals

Your company name should also hint at your core service or industry for SEO and visibility. For instance:

- A tech startup might benefit from names with “Digital”, “Cloud”, or “IT” in them.

- An eCommerce brand could include “Mart”, “Shop”, “Store”, or “Commerce”.

- A logistics company might use “Freight”, “Logix”, “Cargo”, or “Delivery”.

- A healthcare service might include “Care”, “Med”, “Wellness”, or “Clinic”.

Using relevant, industry-specific keywords helps customers (and search engines) immediately understand what you do. This is particularly beneficial if you plan to build a website, run online ads, or rank your business on Google and local business directories.

🔹 Think Long-Term and Legally

Before finalizing a name:

- Search it on the SECP Name Availability Checker to avoid rejection.

- Check domain name availability if you plan to launch a website (e.g., [yourcompanyname].com or .pk).

- Ensure it isn’t too similar to a registered trademark to avoid future legal issues.

- Avoid emotionally driven or trendy names that may become outdated or irrelevant as your business grows.

A strategic name gives you flexibility, boosts your credibility, and positions you for sustainable growth.

Legal Compliance: Prohibited Words and Naming Rules

Before submitting your application for company name reservation in Pakistan, it is crucial to understand and adhere to the naming rules and restrictions set forth by the Securities and Exchange Commission of Pakistan (SECP). These rules are not arbitrary—they are designed to prevent misleading representations, protect the public interest, and avoid confusion among businesses operating under similar names.

Failure to comply with these guidelines can lead to outright rejection of your application, unnecessary delays, and even legal complications down the road. Below is a comprehensive explanation of the SECP’s prohibited terms and compliance requirements when selecting a company name.

🔹 Names with Religious Connotations

The SECP strictly prohibits the use of religious terms or references in a company name unless the entity is directly associated with religious services and is licensed by a relevant authority. Words such as:

- “Islamic”

- “Masjid”

- “Madrassa”

- “Shariah”

- “Zakat”

…can only be used if the applicant provides documented proof of permission or registration under religious institutions or authorities. Using these terms without justification could be seen as deceptive or offensive, and your name will be automatically rejected.

🔹 Use of Country or State Names

You are not allowed to use Pakistan, any province, or foreign country names in your company’s title unless you have special approval. For example:

- “Pakistan Real Estate Authority” would be rejected.

- “Punjab Technologies Pvt Ltd” requires a No Objection Certificate (NOC) from the relevant provincial authority.

- “USA Trading Company” implies foreign affiliation and would need valid documentation to support such usage.

This restriction is in place to prevent businesses from appearing as though they are affiliated with the government, international bodies, or official provincial entities.

🔹 Avoiding Identical or Similar Names

One of the most common reasons for rejection is that the proposed name is too similar to an existing registered company. SECP maintains a strict policy to avoid confusion in the corporate landscape. For example:

- If “TechVision Pvt Ltd” already exists, names like “Tech Vizion” or “TechVision Solutions” are likely to be rejected.

- Names that only differ by a few characters, punctuation, or spelling alterations are not considered unique.

It’s highly recommended to search the SECP database before submitting your name choices. A preliminary name search can help you avoid wasted applications and government fees.

🔹 Prohibited or Sensitive Words

Certain words are either reserved for specific institutions or are seen as misleading. The following are commonly rejected unless backed by legal documentation or special licensing:

- Government: Implies a state-run agency

- Authority: Suggests statutory powers

- Bank / Finance: Restricted to entities regulated by the State Bank of Pakistan

- Exchange, Stock, Market: Associated with capital markets and regulated by SECP or PSX

- Trust, Foundation, Society, NGO: Generally rejected unless you are registering as a non-profit or NPO with proof of compliance

- University, College, School: Require approval from education boards or HEC

- Insurance, Reinsurance: Require licensing from SECP as a regulated insurer

These terms are protected because they convey authority, professionalism, or legal standing that cannot be self-declared. Using them without meeting the legal requirements can be considered misleading advertising or misrepresentation, which is a violation of both the Companies Act, 2017 and the SECP Act.

🔹 Use of Obscene or Offensive Language

The SECP also forbids names that contain:

- Vulgar, derogatory, or indecent words

- Discriminatory terms against any religion, ethnicity, gender, or nationality

- Satirical or mocking language that may damage the reputation of individuals or organizations

🔹 Consult the Official Guidelines

A full and regularly updated list of prohibited and restricted terms can be found in the SECP’s Name Availability Guidelines document, available on their official website. All applicants are advised to review this document before proposing names for reservation.

Important Reminder: SECP has the right to reject a name even if it’s not explicitly listed in the prohibited terms if it deems the name to be misleading, offensive, or not in the public interest.

Case Studies: Successful and Rejected Name Applications

Understanding real-world examples can help you avoid common mistakes during the company name reservation process in Pakistan. Below are some illustrative case studies that highlight what works—and what doesn’t—when proposing a business name to the Securities and Exchange Commission of Pakistan (SECP).

✅ Example 1: Ecomify Pvt Ltd — Approved in 1 Day

The name Ecomify Pvt Ltd was submitted by a tech startup specializing in digital storefront solutions and online payment integration for small businesses. The name was approved within one business day without any need for revisions.

Why it worked:

- The name was clear and relevant to the company’s business activity: eCommerce.

- It was not similar to any existing registered entity in the SECP database.

- It used a modern, coined term (“Ecomify”) that combined relevance with uniqueness.

- The applicant included a detailed and concise business description in Form A, which made the review process smooth.

Takeaway: Names that blend originality with business relevance have a high likelihood of approval, especially when they avoid restricted terms and reflect the company’s core operations.

❌ Example 2: Pakistani Financial Authority — Rejected Due to Prohibited Term

In another case, an entrepreneur attempted to register the name Pakistani Financial Authority for a company that planned to offer financial advisory services. The SECP rejected the application within 24 hours.

Why it was rejected:

- The word “Authority” is among the prohibited terms unless the company is a government-regulated body or statutory organization.

- Including “Pakistani” and “Authority” together implied official or governmental backing, which the business did not possess.

- The name could easily be misunderstood as a government agency or financial regulator, violating SECP’s misrepresentation clause.

Takeaway: Always consult the SECP’s Name Availability Guidelines before submitting names. Words that imply government endorsement or regulatory power are likely to be denied unless you have documented proof of official authorization.

⚠️ Example 3: Z-Tech Group — Initially Rejected, Then Approved with Revision

A tech hardware reseller proposed the name Z-Tech Group, which was initially rejected by SECP because it bore similarity to an existing company named Z-Tech Technologies Pvt Ltd. The name created confusion due to the use of a common prefix and general business-related suffix (“Group” vs. “Technologies”).

Instead of abandoning the application, the founders revised their name and resubmitted it as Z-Tech Holdings Pvt Ltd. This new version was approved within 2 days, as it introduced a meaningful differentiation and better aligned with their new business model, which included plans for investment and asset management.

Why the revised name worked:

- “Holdings” clarified the structure and intent of the company, reducing the risk of confusion.

- The applicant provided an updated business description aligned with the term “Holdings.”

- The name no longer infringed upon the trademark identity of the existing registered business.

Takeaway: If your name is too similar to an existing company, don’t give up—revise it strategically. Consider changing the suffix (e.g., Group, Solutions, Holdings, Enterprises) and ensure your business description is detailed and aligned.

🎓 Bonus Insights from Arshad & Associates

As experienced consultants in company formation and SECP compliance, we’ve observed that name rejections are often due to:

- Overuse of generic words (e.g., “Tech”, “Global”, “Solutions”) without proper context

- Attempting to mimic well-known brands or corporations

- Failure to indicate the correct company type (e.g., omitting “(Pvt.) Ltd.”)

- Submitting vague or incomplete business activity descriptions

When working with Arshad & Associates, you’ll benefit from our expertise in crafting names that are:

- Legally compliant

- Search engine optimized

- Memorable and scalable

- Aligned with your vision and industry

We conduct pre-submission checks, offer name refinement suggestions, and even help you draft compelling business descriptions that align with SECP’s expectations.

Registering with FBR After Company Name Approval

Once your company name is successfully reserved through the SECP and your business is incorporated, the next crucial step is to register your company with the Federal Board of Revenue (FBR). This is a mandatory requirement for any legal entity operating in Pakistan, and it forms the basis for tax compliance and financial transparency.

FBR registration ensures that your company is visible to tax authorities, legally recognized for commercial transactions, and fully compliant with national tax laws and regulations. It also enables you to open a business bank account, participate in government tenders, and issue official tax invoices.

Here is a breakdown of the key steps involved in the FBR registration process after company incorporation:

🔹 1. Obtaining an NTN (National Tax Number)

The first and most fundamental step is acquiring a National Tax Number (NTN) for your newly registered company. The NTN serves as the unique identifier for your business in the FBR system, similar to a Social Security Number (SSN) for individuals in other countries.

Why it matters:

- An NTN is required to file income tax returns, pay withholding taxes, and register for sales tax.

- It enables your company to operate formally and be recognized by vendors, suppliers, and customers for tax documentation.

To apply, you must submit:

- SECP Certificate of Incorporation

- CNIC of directors

- Proof of business address (rental agreement, utility bill)

- Bank account details

You can apply online via FBR’s IRIS portal or visit your local tax office.

🔹 2. Registering for Sales Tax (If Applicable)

If your business involves the supply of taxable goods or services, such as manufacturing, importing, or selling items with a sales tax component, you are required to register for Sales Tax with FBR.

Businesses in sectors such as:

- Retail and wholesale

- eCommerce and digital services

- Construction and real estate

- Import/export

…must charge, collect, and remit sales tax to the government.

Bonus Tip: Businesses with sales exceeding the threshold defined by FBR (e.g., Rs. 10 million for retailers) are automatically required to register for sales tax. This ensures your compliance with the Sales Tax Act, 1990 and avoids hefty penalties.

🔹 3. Filing Annual Income Tax Returns

Once registered with FBR, your company is obligated to file annual income tax returns—regardless of whether you made a profit, loss, or zero income.

Income tax filing includes:

- Reporting business income and expenses

- Claiming allowable deductions and depreciation

- Declaring salaries, profits, dividends, and investments

- Submitting balance sheet and profit & loss statement

Timely filing of income tax returns keeps your company compliant under the Income Tax Ordinance, 2001 and builds your tax history, which is essential for:

- Applying for business loans

- Visa and immigration processes

- Participating in government tenders

- Avoiding audit triggers

Using a professional tax accountant or tax advisor—like those at Arshad & Associates—can help you maximize deductions and avoid errors that could trigger notices from the income tax department.

🔹 4. Deducting and Remitting Withholding Taxes

Under Pakistani tax law, companies are designated as withholding agents, which means they are legally required to deduct tax at source when making payments such as:

- Employee salaries

- Contractor fees

- Rent

- Professional services

- Commission and brokerage

These deductions, known as withholding tax (WHT), must then be deposited with FBR under the appropriate head codes.

Examples of WHT obligations:

- Deducting 10% WHT on professional service invoices

- Deducting income tax from employee salaries based on the income tax slab

- Deducting 7.5% WHT on rent payments to landlords

Proper management of withholding tax requires:

- Knowledge of applicable tax rates

- Timely deposit of deductions

- Filing monthly and annual WHT statements

Failure to deduct or remit WHT can lead to heavy penalties and interest, along with legal scrutiny.

🔹 5. Filing Payroll and Withholding Statements

If you employ staff, you must implement a payroll management system that handles:

- Salary calculation

- Tax deduction at source

- Issuance of monthly payroll slips

- Submission of monthly and annual statements to FBR

For each employee, payroll statements must reflect:

- Gross and net salary

- Tax deducted

- Allowances and benefits

- Provident fund or gratuity contributions

These filings must be submitted via the FBR IRIS portal on a monthly basis to remain compliant. Accurate payroll reporting also builds employee trust and protects your company during audits or labor inspections.

At Arshad & Associates, we help companies implement quick payroll systems using tools like QuickBooks Online, ZohoBooks, and Xero Accounting, ensuring timely compliance and real-time reporting.

🎯 Why FBR Registration Is Essential

Failing to register with the FBR or delaying tax compliance can:

- Result in financial penalties

- Lead to blacklisting by suppliers and clients

- Trigger audits or legal notices

- Restrict your ability to access funding or contracts

Timely and accurate FBR registration builds your business’s legal credibility, improves transparency, and opens the door to growth opportunities both locally and internationally.

Setting Up Bookkeeping and Payroll After Incorporation

Once your business has been successfully incorporated and registered with the Federal Board of Revenue (FBR), the next essential step is to implement a solid financial management infrastructure. Proper bookkeeping, payroll, and accounting systems are critical for ensuring compliance, supporting tax filings, managing cash flow, and tracking the overall health of your business.

Whether you’re a startup or a growing SME, neglecting this phase can lead to regulatory issues, disorganized finances, and poor decision-making. Here’s what a post-registration financial setup typically includes:

🔹 1. Chart of Accounts (CoA)

A Chart of Accounts is a systematic listing of every account used in your business’s general ledger. It acts as the backbone of your accounting system, categorizing all financial transactions into relevant groups such as assets, liabilities, income, expenses, and equity.

Example CoA categories include:

- Cash in bank

- Accounts receivable

- Inventory

- Salaries and wages

- Marketing and advertising

- Utilities and rent

- Sales revenue

A well-structured chart of accounts makes it easier to track financial activity, prepare reports, and ensure accurate bookkeeping entries. It also helps align your records with income tax return categories, ensuring smooth compliance.

🔹 2. General Ledger

The general ledger is the master record that contains all the financial transactions of your business, organized by account. It is the primary source of your company’s financial data and forms the basis for generating your:

- Trial balance

- Profit and loss statement

- Balance sheet

Accurate entries in the general ledger ensure that your business books are in sync with accrual accounting principles, which recognize revenue and expenses when they are earned or incurred, not when cash is exchanged.

The general ledger must be updated consistently to avoid discrepancies, especially when preparing for income tax filing or responding to FBR audits.

🔹 3. Bank Reconciliation Statements

Bank reconciliation is the process of matching your internal financial records with your bank statements to ensure consistency. Every month, your accountant or bookkeeper should reconcile:

- Deposits made and cleared

- Withdrawals, payments, and charges

- Bank fees or interest

- Outstanding checks and pending transactions

This process helps identify:

- Errors in recording

- Fraudulent activity

- Missing transactions

- Unrecorded bank charges

Regular bank reconciliation is essential for maintaining accurate cash flow tracking and ensuring that your tax filings and financial statements are based on reliable data. It also improves trust with stakeholders, investors, and auditors.

🔹 4. Accrual Accounting System

Most businesses in Pakistan operate under an accrual accounting system, especially when incorporated. Unlike cash accounting, accrual accounting records income when it is earned and expenses when they are incurred—regardless of when the money actually changes hands.

Why accrual accounting matters:

- Provides a more accurate picture of financial health

- Helps anticipate revenue and liabilities

- Required for accurate financial reporting and double entry bookkeeping

- Necessary for businesses subject to withholding tax or sales tax obligations

Using accrual accounting ensures your income and expenses align with your operational cycles, making it easier to forecast profits, manage resources, and comply with taxation regulations.

🔹 5. Payroll System and Payslip Generation

If you employ staff, setting up a proper payroll management system is critical for ensuring timely salary payments, tax deductions, and regulatory compliance. A modern payroll system should:

- Track employee working hours and leaves

- Calculate gross and net salaries

- Deduct applicable income tax and EOBI/SSGCL contributions

- Generate monthly payroll slips

- Automate payroll tax filings and statements

You are also required to submit employee tax and payroll records to the FBR and maintain proper documentation for internal audits or inspections.

Manual payroll processing is not only time-consuming but also prone to errors. Adopting a digital payroll solution helps eliminate mistakes and ensures real-time compliance with Pakistan’s tax withholding and employment laws.

🔹 Recommended Accounting Software

To streamline the above processes, we strongly recommend cloud-based accounting software platforms like:

- QuickBooks Online – Ideal for SMEs and startups, offers customizable CoA, payroll integration, bank reconciliation, and automated tax calculations.

- ZohoBooks – Great for businesses needing multi-user access, client portals, and automation of recurring invoices and journal entries.

- Xero Accounting – Excellent for real-time collaboration with accountants, automatic bank feeds, and comprehensive reporting features.

These platforms allow you to manage:

- General ledger

- Double entry accounting

- Accounts receivable and payable

- Income tax withholding

- Paycheck management

All while staying compliant with Pakistani taxation standards and integrating with popular payroll tools.

At Arshad & Associates, we help businesses not only choose the right accounting software but also implement, customize, and maintain it for optimal financial performance.

Frequently Asked Questions

The company name reservation process may seem simple at first glance, but there are nuances that many first-time entrepreneurs and foreign investors often overlook. Below are detailed answers to some of the most commonly asked questions about reserving a company name through the Securities and Exchange Commission of Pakistan (SECP).

Can I reserve a name without immediate registration?

Yes, absolutely. Once your company name is approved by SECP, it is reserved for a period of 60 days. During this time, you are not required to immediately move forward with full company registration in Pakistan, but you must complete the registration process before the 60-day period expires. If you fail to register the company within this time frame, the name will be released and become available for others to reserve.

This grace period is particularly useful for:

- Finalizing your business plan and operations model

- Consulting with tax advisors or accountants

- Preparing incorporation documents

- Arranging capital or legal compliance

If you need more time, you can apply for a name re-reservation, but it’s always better to act within the original window to avoid the risk of losing your chosen name.

Can a foreign national reserve a name?

Yes. Foreign individuals and entities are permitted to reserve and register company names in Pakistan, provided they meet certain documentation and identity verification requirements. The SECP allows non-resident investors to incorporate businesses, subject to compliance with national regulations.

Foreign nationals must:

- Register on the SECP eServices Portal

- Submit a valid passport copy for identity verification

- Provide a business description and proposed company name(s)

- Follow standard procedures for payment and submission

Foreign investors are encouraged to partner with local consultants or legal advisors—like Arshad & Associates—to navigate not only the name reservation process but also income tax registration, corporate bank account setup, and regulatory compliance with the State Bank of Pakistan (SBP), especially in cases involving foreign direct investment (FDI).

How long does name approval take?

In most cases, company name reservation requests are processed within 1 to 2 working days, provided the application is complete and the proposed name does not violate SECP guidelines. The turnaround time can be shorter if:

- The name is unique and clearly aligned with the business activity

- There are no prohibited terms used (like “Bank,” “Foundation,” or “Government”)

- The applicant has submitted all supporting documents and paid the Rs. 200 fee promptly

If your application is incomplete or your name closely resembles another registered company, SECP may issue a rejection or ask for clarification, which can add a few extra days to the process.

Pro tip: Always use the SECP Name Search Tool to check for conflicts before applying.

Can I reserve multiple names?

Yes, SECP allows you to propose up to three name options in a single name reservation application. These names should be listed in order of preference—from your top choice to two alternatives. SECP will evaluate all three but will approve only one name, typically the first one that meets all legal and regulatory criteria.

This feature increases your chances of quick approval, especially if:

- You are unsure about the availability of your primary name

- You want to secure a name quickly without multiple back-and-forth applications

- You have a backup plan if your preferred brand name is unavailable

Each application requires the Rs. 200 fee, regardless of how many names you submit, and the selected name will be reserved for 60 days.

Do I need legal help for name reservation?

Technically, no—it is not mandatory. The SECP’s eServices Portal is designed to allow entrepreneurs and business owners to reserve names and register companies without intermediaries. However, many people—especially first-time founders, foreign investors, and those unfamiliar with Pakistani regulations—choose to consult business registration experts, bookkeepers, or tax consultants for support.

Working with experienced firms like Arshad & Associates can help:

- Ensure your proposed names comply with SECP rules

- Avoid restricted or misleading terms

- Prepare a strong and clear business activity description

- Prevent application rejections or delays

- Align your name choice with accounting, bookkeeping, taxation, and branding strategies

If your company will also need assistance with payroll, chart of accounts setup, QuickBooks Online, income tax filing, or sales tax registration, it’s wise to bundle these services under one umbrella with an expert consultant.

🚀 Ready to Register and Launch Your Business?

At Arshad & Associates, we make your business launch seamless and stress-free.

📈 From name reservation to full incorporation, FBR registration, and end-to-end accounting support, our experts ensure compliance, clarity, and long-term scalability.

💼 We offer:

– Company registration with SECP

– Tax filing and FBR registration

– QuickBooks and Xero setup

– Payroll and payslip automation

– Bookkeeping and ledger management

– Income tax planning and compliance

📞 Call us at 0331-566-1278

📧 Email: info@arshadassociates.com | talhaarshad97@gmail.com

🌐 Visit: https://arshadassociates.com/

**Let’s turn your business idea into a registered success today!**