Why PSEB Renewal Matters in 2025

Renewing your registration with the Pakistan Software Export Board (PSEB) is not just an annual requirement—it’s a gateway to retaining your IT exporter status, maintaining reduced tax rates, and staying eligible for critical government incentives. Whether you’re a solo freelancer, an IT services company, or a startup, PSEB renewal in 2025 ensures you’re legally recognized and positioned for growth in Pakistan’s digital economy.

With increasing scrutiny from tax authorities and evolving compliance standards from FBR and SBP, staying updated and proactive is more important than ever.

What is PSEB Registration?

PSEB registration certifies individuals and companies that offer Information Technology (IT) and IT-enabled Services (ITeS) and export these services globally. This certification:

- Verifies your exporter status to State Bank of Pakistan (SBP) and Federal Board of Revenue (FBR)

- Qualifies you for the 0.25% reduced tax rate on IT exports

- Enables participation in international tech expos, grants, and subsidized training

- Allows access to visa facilitation letters for overseas travel related to business

Who Must Renew PSEB Registration in 2025?

All categories of IT exporters must renew their registration annually:

| Entity Type | Renewal Required? |

| Individual Freelancer | ✅ Yes |

| Sole Proprietor | ✅ Yes |

| Single Member Company (SMC) | ✅ Yes |

| Private Limited Company | ✅ Yes |

| LLP/Partnership engaged in IT exports | ✅ Yes |

Failure to renew results in loss of exporter status, ineligibility for SBP-coded PRCs, and increased tax liability (1%).

2025 PSEB Renewal Fees

| Category | Annual Fee (PKR) | Notes |

| Individual/Freelancer | 2,000 | Fixed |

| Company (SMC/Pvt/LLP) | 1,5000–20,000 | Based on structure |

| Payment Modes | Debit/Credit Card, Pay Order | Online payments subject to portal availability |

Pay Order Title:

Pakistan Software Export Board (G) Ltd

NTN: 2315376-8

Required Documents for Renewal (2025 Checklist)

| Document | Details |

| Valid NTN Certificate | Must match your name or company’s name |

| CNIC Copy | Both sides in PDF/JPG format |

| Bank Account Maintenance Certificate | From your bank; must mention your name, account number, and be issued within last 30 days |

| Payment Remittance Certificates (PRCs) | Must mention SBP Purpose Code “9186” for IT exports |

| Latest Income Tax Return (FBR) | Filed return for last year showing foreign remittance |

| Previous PSEB Certificate (if applicable) | Recommended for record verification |

⚠️ Note: If this is your first renewal and PRCs are unavailable, you may submit an affidavit. This is only acceptable once.

Step-by-Step Guide to Renew PSEB Registration (2025)

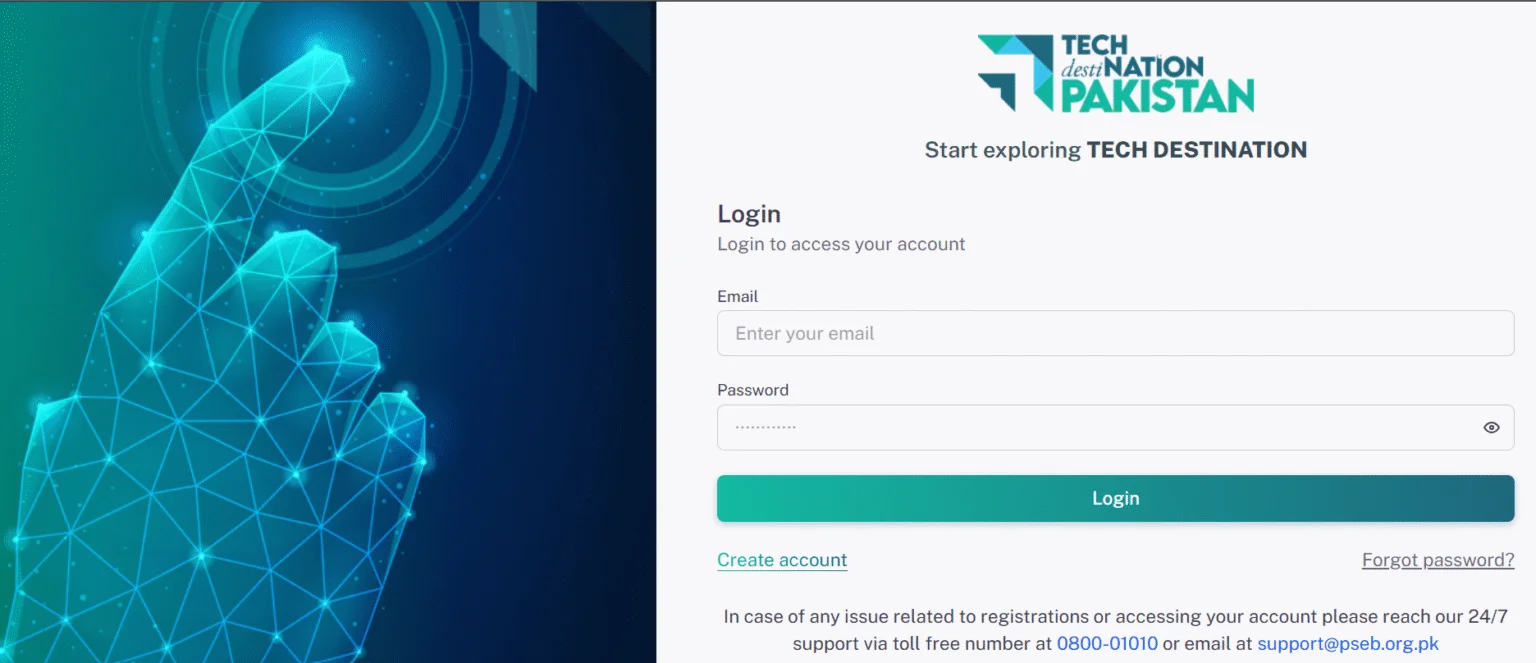

Step 1: Access the Official Portal

- Go to Tech Destination Registration Portal

- Log in using your credentials or recover via “Forgot Password”

Step 2: Choose “Renew Registration”

- Click the “Renew” button on your dashboard

- Select your category (Freelancer, SMC, Pvt Ltd, etc.)

Step 3: Update Your Profile Information

- Verify business name, email, contact number

- Confirm export income, bank account details, and nature of services

- Update if your address or tax details changed

Step 4: Upload Required Documents

- Upload each file as PDF or JPEG, max 2MB each

- Suggested filenames: NTN.pdf, PRC_2024_9186.pdf, FBR_TaxReturn.pdf

Step 5: Pay the Renewal Fee

- Online Method (if active): Pay by card on the portal

- Offline Method:

- Get a Pay Order addressed to: Pakistan Software Export Board (G) Ltd

- Write your name/CNIC or Company name at the back

- Upload scanned copy in the portal

- Send original to:

PSEB Head Office, Evacuee Trust Complex, Islamabad

Step 6: Application Review and Approval

- Application status: “Under Review”

- Review time: 2–5 working days

- If any documents are missing, you’ll receive a follow-up email

Step 7: Download Renewed Certificate

- Once approved, the certificate becomes downloadable from your dashboard

- Save it as PDF and print it for use with FBR, SBP, or clients

Common Renewal Issues (and How to Avoid Them)

| Issue | Cause | Resolution |

| ❌ PRC not available | Payment via Wise/Skrill | Always use banks or Payoneer (with SBP code 9186) |

| ❌ ITR not filed | Late return or zero income not declared | File NIL returns if needed; required for all renewals |

| ❌ Wrong remittance code | Bank error | Instruct bank to use 9186 for IT services |

| ❌ Delay in verification | Pay Order not uploaded | Upload proof immediately after generating PO |

Bonus Tips for Hassle-Free Renewal

✅ Renew 30 days before expiry to avoid last-minute issues

✅ File your tax return (even NIL) on time with declared export income

✅ Use a freelancer-friendly bank (UBL Freelancer Account, Meezan Freelancer Asaan)

✅ Avoid using untraceable platforms for payments

✅ Maintain a digital folder with labeled copies of all documents

Why Renewal is More Important Than Ever in 2025

With Pakistan’s IT export ecosystem under tighter compliance, PSEB registration is becoming a standard requirement for:

- Export income taxation at 0.25%

- Participation in MoITT, Ignite, or PSEB grant programs

- Visa facilitation for Tech Events (GITEX, Web Summit)

- Trust building with international clients

- Bank compliance and FBR record validation

If your PSEB registration expires, you are no longer considered an official exporter and will be subject to the higher tax bracket of 1%—plus you risk losing bank incentives, visa support, and credibility with clients.

Frequently Asked Questions (FAQs)

Q1. Can I renew my PSEB certificate if I haven’t received payments recently?

Yes, but you must still file your Income Tax Return and submit an affidavit if PRCs are unavailable (only for the first renewal).

Q2. What happens if I miss the renewal deadline?

Your profile will be marked “expired,” and you may lose tax benefits, visa letters, and program access until renewed.

Q3. Are Payoneer transfers acceptable?

Yes, as long as they come through local banks and are coded properly under SBP 9186.

Q4. Can I renew if I’ve switched banks?

Yes, but ensure the new bank issues a valid Account Maintenance Certificate and PRC.

Q5. How long does PSEB take to process renewals?

Typically 2–5 working days after all documents are uploaded correctly.

Final Thoughts: Stay Compliant, Stay Competitive

In today’s global IT economy, PSEB renewal is your compliance backbone. It’s not just a certificate—it’s your entry ticket to tax savings, client trust, and international visibility.

Make the 2025 renewal process seamless by staying prepared, keeping your documentation accurate, and following each step with care. If you’re a freelancer or run an IT firm, now is the time to make compliance a core part of your business strategy.

✅ Need Help with Tax Filing, PRCs, or Compliance Documentation?

We work with IT exporters, software houses, and freelancers across Pakistan to help you:

- File accurate tax returns with declared export income

- Manage PRCs and SBP code compliance

- Set up bank accounts that support digital export operations

- Track financials and stay audit-ready

📞 Call Now: +92 331 5661278

📧 Email: info@arshadassociates.com

🌐 Visit: www.arshadassociates.com

Let Arshad & Associates handle your backend so you can focus on building your digital future.